2022

The acquisition of PUR, a B2B developer of natural climate solutions projects and an impact-focused company.

2023

Founding of the Bregal Sphere platform.

2024

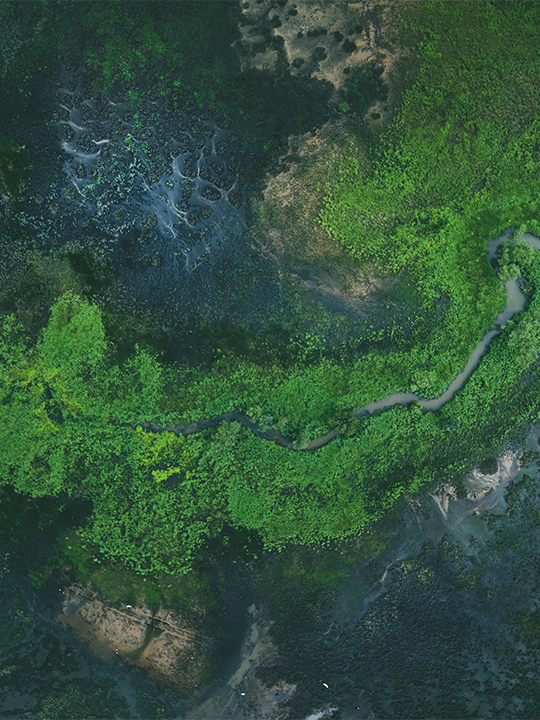

Launch of the Bregal Sphere Nature strategy, focused on nature-based project investments.